The digital insurance experience is lagging.

Digital experiences in healthcare have progressed exponentially over the last few years: from administrative AI to smartphone app diagnosis, but payers seem to have fallen behind in this realm. According to a J.D. Power report, the digital insurance experience isn’t where it should be.

J.D. Power defines four basic functions of apps and websites, including: digital functionality, organization and visual appeal. Out of the 5,590 members that were surveyed, including the 14 largest Medicare Advantage plans and 15 of the largest commercial member health plans, roughly one third of insurer’s apps and websites failed on these basic functions.

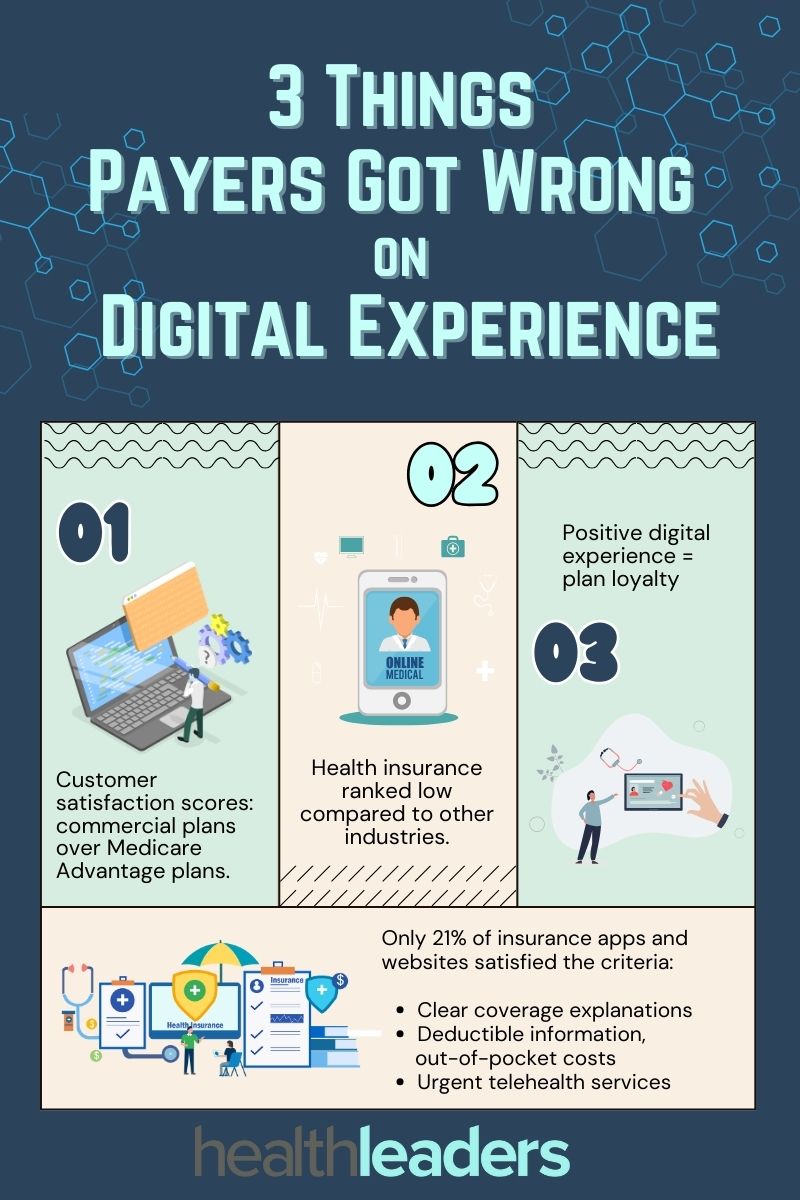

Overall only 21% of the digital properties met all the criteria to be considered high-functioning digital solutions, such as clear explanations of coverage, provided information on deductibles and out-of-pocket costs, and offering urgent telehealth services.

Here are three notes on the digital insurance experience:

Commercial plan members had a better digital experience than MA plan members, and overall rated it more highly: commercial plan apps and websites had an average customer satisfaction rating 646 out of 1,000, compared to 629 for MA plans.

Health insurers ranked low for digital experience compared to other industry scores. Property and casualty insurance averaged a score of 700 for customer satisfaction, and self-directed wealth management apps had a score of 718.

When MA plan members had a positive digital experience, it was linked with their intent to stay with the plan. In MA plans that received scores of 801 or higher, 89% of members said they would definitely stick with the same plan.

Marie DeFreitas is the finance editor for HealthLeaders.