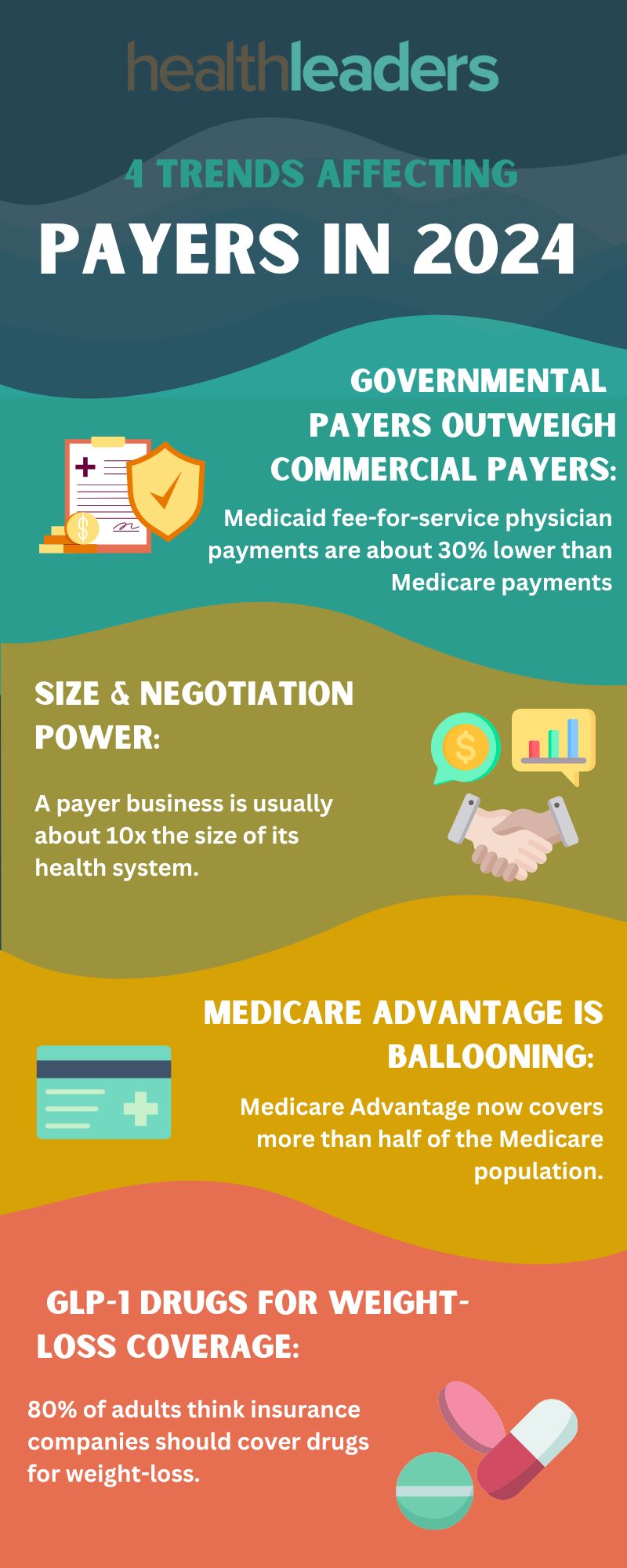

Four trends are shaping the payer landscape in 2024.

Governmental payers outweigh commercial payers: With the immense growth of government-funded programs like Medicare and Medicaid, hospitals and health systems have become too reliant on these systems. Medicaid fee-for-service physician payments are about 30% lower than Medicare payments, and commercial payments are even lower than that. Medicaid expansion has been booming lately and the program now has even more enrollees than Medicare programs.

Size & Negotiation Power: Often, a payer business is about ten times the size of its health system. Providers are fed up with the lack of negotiation power when they’re contracting with these insurance giants. When payers hold the majority of negotiation power in contracts providers' reimbursement rates also tend to suffer. For example, a 2023 analysis showed that the top insurer in the least competitive insurance markets pays about 15% less to health systems than the top insurer in the most competitive markets. Payers may be profiting, but it’s through unsustainable strategies. The trajectory of payer/provider relations will have to change for hospitals and health systems to stabilize and provide better health outcomes.

Medicare Advantage Is Ballooning: MA now covers more than half of the Medicare population. Payers have seen a lot of profit from MA but also a lot of regulatory headaches and rate cuts. Despite any speed bumps, payers are still basking in the cash flow of the MA market; the CMS overpaid an estimated $75 billion to MA organizations in 2023.

To Cover or Not To Cover? GLP-1 Drugs for Weight-Loss: Diabetes/obesity drugs have become the popular kid and have seen more coverage last year and leading into this year, which is set to keep increasing. One KFF study showed that about 80% of adults think insurance companies should cover these drugs for obesity, and 53% think they should be covered for general weight loss.

Marie DeFreitas is the finance editor for HealthLeaders.