Mergers and acquisitions are on the mind of every CEO and CFO as leaders need to develop a strategic path to a financially sustainable future.

As CFOs and CEOs fight against poor operating margins, reduced reimbursement, and inflated expenses, developing and executing a strategic path to a financially sustainable future is essential. For some, this can mean an acquisition or merger.

Hospitals and health systems of every type are feeling the financial pressure—even nonprofits will continue to grapple with existential questions about their strategy and structure moving forward.

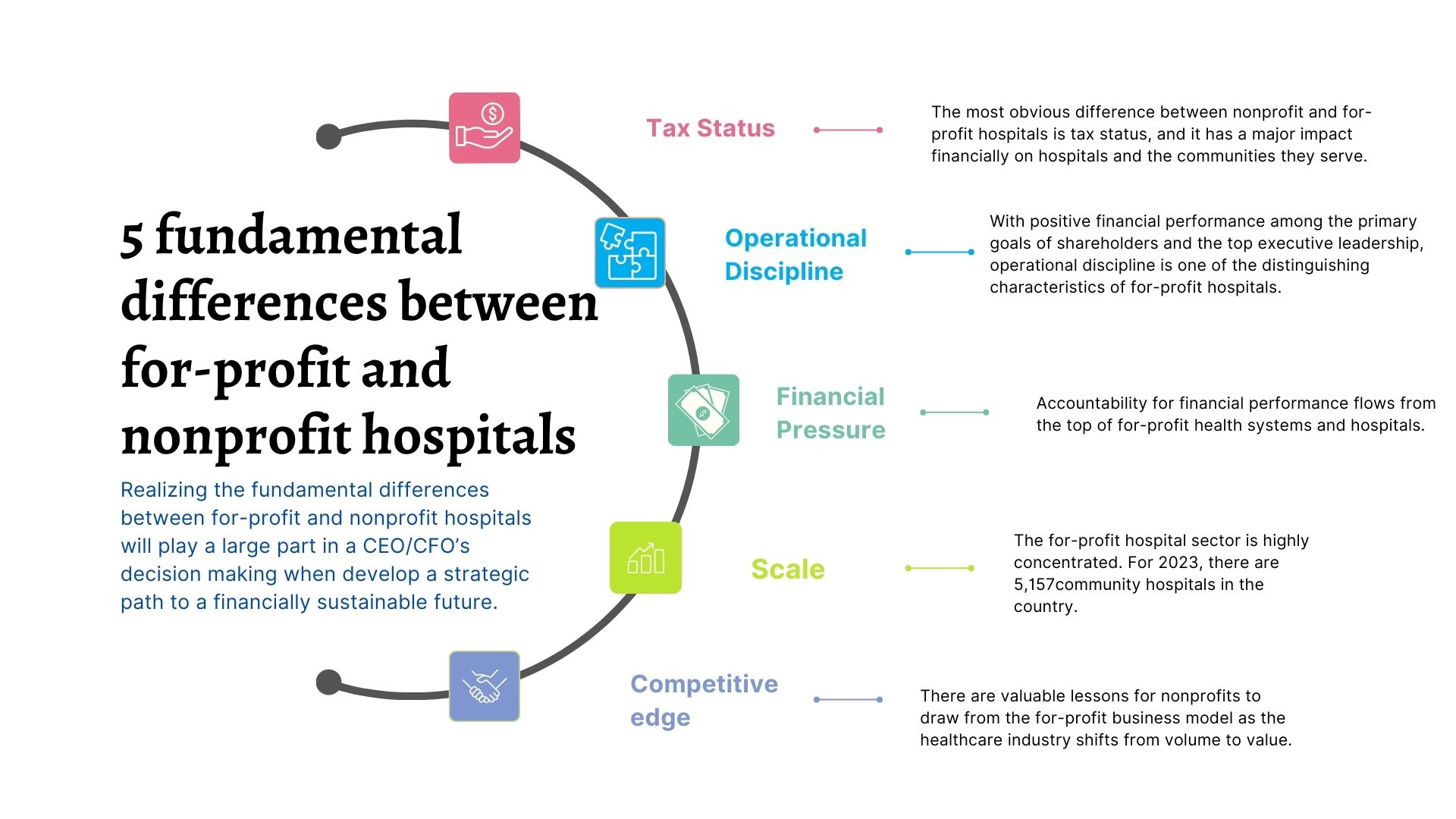

Realizing the fundamental differences between for-profit and nonprofit hospitals will play a large part in a leader’s decision making.

For-profit and nonprofit hospitals are fundamentally similar organizations with subtly different cultural approaches to managing the economics of healthcare. All acute care hospitals serve patients, employ physicians and nurses as their primary personnel, and operate in the same regulatory framework for delivery of clinical services.

There are, however, a few primary differences between for-profit and nonprofit hospitals, which could potentially impact ROI. Read on about these differences, updated from our previous coverage.

Tax Status

The most obvious difference between nonprofit and for-profit hospitals is tax status, and it has a major impact financially on hospitals and the communities they serve.

Hospital payment of local and state taxes is a significant benefit for municipal and state governments, said Gary D. Willis, a former for-profit health system CFO said. The taxes that for-profit hospitals pay support "local schools, development of roads, recruitment of business and industry, and other needed services," he said.

The financial burden of paying taxes influences corporate culture—emphasizing cost consciousness and operational discipline. For example, for-profit hospitals generally have to be more cost-efficient because of the financial hurdles they have to clear.

Operational Discipline

With positive financial performance among the primary goals of shareholders and the top executive leadership, operational discipline is one of the distinguishing characteristics of for-profit hospitals, said Neville Zar, the former senior vice president of revenue operations at Steward Health Care System, a for-profit that includes 3,500 physicians and 18 hospital campuses in four states.

When Zar was at the system, a revenue-cycle dashboard report was circulated at Steward every Monday morning at 7 a.m., including point-of-service cash collections, patient coverage eligibility for government programs such as Medicaid, and productivity metrics.

A high level of accountability fuels operational discipline at for-profits, Zar said.

Financial pressure

Accountability for financial performance flows from the top of for-profit health systems and hospitals, said Dick Escue, senior vice president and CIO at the Hawaii Medical Service Association in Honolulu.

Escue worked for many years at a rehabilitation services organization that for-profit Kindred Healthcare of Louisville, Kentucky, acquired in 2011. "We were a publicly traded company. At a high level, quarterly, our CEO and CFO were going to New York to report to analysts. You never want to go there and disappoint. … You're not going to keep your job as the CEO or CFO of a publicly traded company if you produce results that disappoint."

Finance team members at for-profits must be willing to push themselves to meet performance goals, Zar said.

For-profit hospitals also routinely utilize monetary incentives in the compensation packages of the C-Suite leadership, said Brian B. Sanderson, managing principal of healthcare services at Crowe.

"The compensation structures in the for-profits tend to be much more incentive-based than compensation at not-for-profits," he said. "Senior executive compensation is tied to similar elements as found in other for-profit environments, including stock price and margin on operations."

In contrast to offering generous incentives that reward robust financial performance, for-profits do not hesitate to cut costs in lean times, Escue says.

"The rigor around spending, whether it's capital spending, operating spending, or payroll, is more intense at for-profits. The things that got cut when I worked in the back office of a for-profit were overhead. There was constant pressure to reduce overhead," he says. "Contractors and consultants are let go, at least temporarily. Hiring is frozen, with budgeted openings going unfilled. Any other budgeted, but not committed, spending is frozen."

Scale

The for-profit hospital sector is highly concentrated. For 2023, there are 5,157 community hospitals in the country, according to the American Hospital Association. Nongovernmental not-for-profit hospitals account for the largest number of facilities at 2,978. There are 1,235 for-profit hospitals, and 944 state and local government hospitals.

On the other hand, the country's for-profit hospital trade association, the Federation of American Hospitals, represents 1,000 tax-paying community hospitals and health systems throughout the U.S., accounting for nearly 20% of U.S. hospitals.

Scale generates several operational benefits at for-profit hospitals.

"Scale is critically important," said Julie Soekoro, former CFO of a Community Health Systems (CHS)-owned hospital. And one benefit of being CHS-owned? The access to resources and expertise, Soekoro said at the time.

Best practices are shared and standardized across all CHS hospitals. "Best practices can have a direct impact on value," Soekoro says. "The infrastructure is there. For-profits are well-positioned for the consolidated healthcare market of the future… You can add a lot of individual hospitals without having to add expertise at the corporate office."

The High Reliability and Safety program at CHS is an example of how standardizing best practices across the health system's hospitals has generated significant performance gains, she says.

Scale also plays a crucial role in one of the most significant advantages of for-profit hospitals relative to their nonprofit counterparts: access to capital.

Ready access to capital gives for-profits the ability to move faster than their nonprofit counterparts, Sanderson says. "They're finding that their access to capital is a linchpin for them. … When a for-profit has better access to capital, it can make decisions rapidly and make investments rapidly. Many not-for-profits don't have that luxury."

Competitive edge

There are valuable lessons for nonprofits to draw from the for-profit business model as the healthcare industry shifts from volume to value.

When healthcare providers negotiate managed care contracts, for-profits have a bargaining advantage over nonprofits, Doran says. "In managed care contracts, for profits look for leverage and nonprofits look for partnership opportunities. The appetite for aggressive negotiations is much more palatable among for-profits."

Amanda Norris is the Director of Content for HealthLeaders.

KEY TAKEAWAYS

Hospitals and health systems of every type are feeling the financial pressure—even nonprofits will continue to grapple with existential questions about their strategy and structure moving forward.

Realizing the fundamental differences between for-profit and nonprofit hospitals will play a large part in a CEO/CFO's decision making.

There are a few primary differences between for-profit and nonprofit hospitals which could potentially impact ROI.