Year-to-date, Cigna share prices are down 10.3% (as of Dec. 10, 4:00 pm ET). But its investors netted big short-term gains after news broke that deal talks were off between Cigna and Humana.

Jackpot. On Monday, Cigna Group shareholders banked a 16% increase, the company’s biggest gain in 14 years (MarketWatch). Year-to-date, Cigna share prices are down 10.3% (as of Dec. 10, 4:00 pm ET). But its investors netted big short-term gains after news broke that deal talks were off between Cigna and Humana. More on that here.

Who’s reaping the gains?

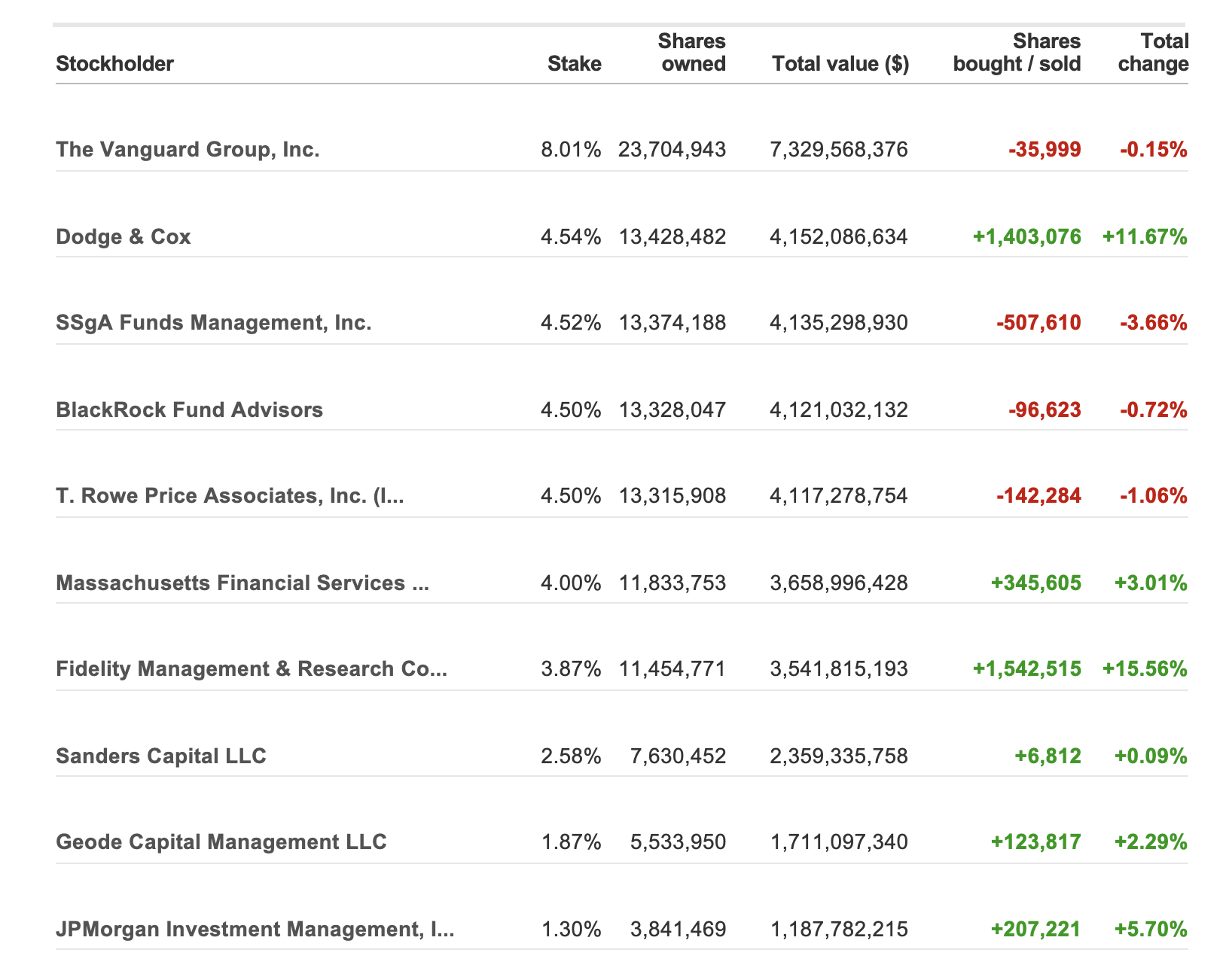

Institutional investors make up nearly 89% of Cigna's ownership, not uncommon for managed healthcare companies (CNN Business). Among Cigna's largest investors are the world's two largest investment firms — Vanguard Group, Inc. and BlackRock. Vanguard holds nearly twice as many shares as BlackRock (8.01% versus 4.5%) and a handful of other institutional investors in the 4% club.

That club also includes Dodge & Cox and Massachusetts Financial Services (now known as MFS Investment Management), which have increased their shares by 11.67% and 3.01%, respectively (time frame unknown). Other top purchasers include Fidelity Management & Research (3.87% stake, +15.56% gained) and JPMorgan Investment Management (1.3% stake, +5.7% gained)

The rest of the top 10 is here, including Cigna’s biggest institutional buyers and sellers.

Top 10 Owners of Cigna Group

Source: CNN Business (Dec. 14, 2023)

Laura Beerman is a contributing writer for HealthLeaders.